What Are Stablecoins?

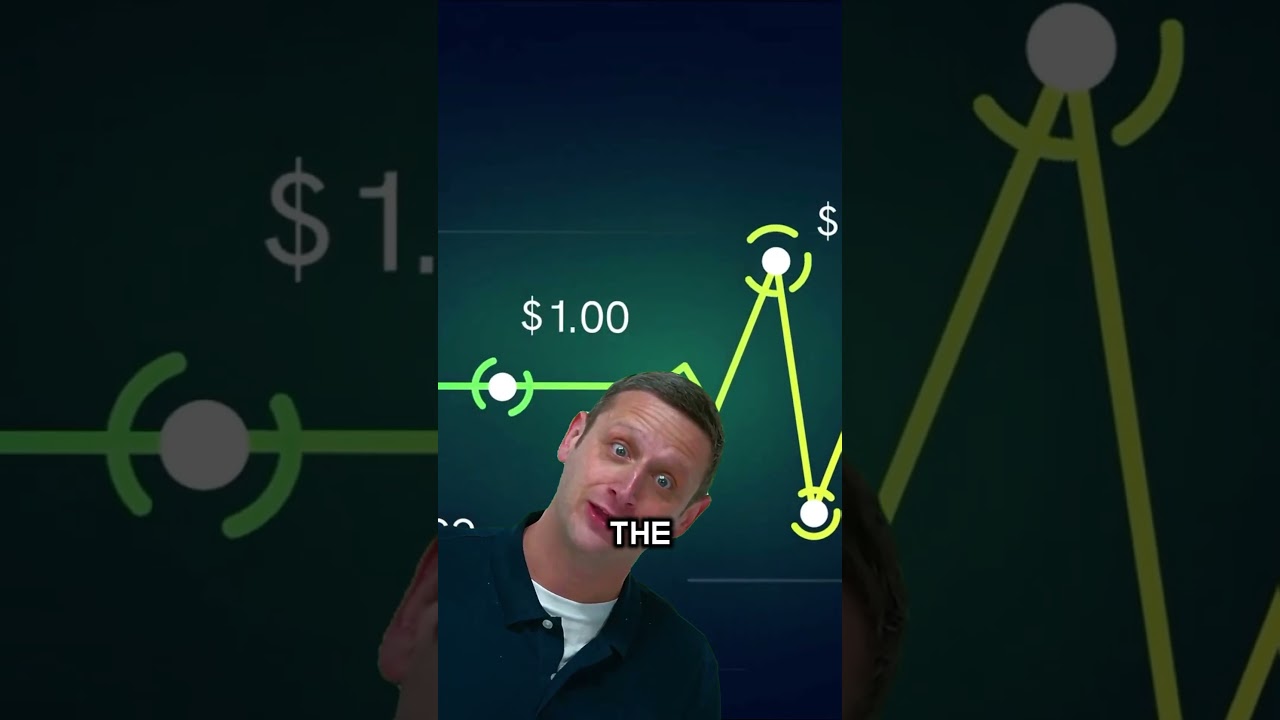

Stablecoins are a type of cryptocurrency designed to have a stable value by being pegged to a reserve asset, such as a currency. The most common stablecoins are pegged to the US dollar, meaning that one stablecoin equals one dollar. This stability makes them appealing for trading in the volatile crypto market.

How Do Stablecoins Work?

Stablecoins typically use one of three methods to maintain their value:

- Fiat-Collateralized Stablecoins: These stablecoins are backed by a reserve of fiat currency, like the US dollar. For every stablecoin created, an equivalent amount of the fiat currency is held in reserve.

- Crypto-Collateralized Stablecoins: These are backed by other cryptocurrencies. Since cryptocurrencies can be volatile, to maintain stability, these stablecoins often require over-collateralization—meaning that more cryptocurrency is held in reserve than the amount of stablecoins issued.

- Algorithmic Stablecoins: These stablecoins use algorithms and smart contracts to manage their supply. When demand increases, new coins are minted; when demand decreases, coins are taken out of circulation.

Importance of Stablecoins in the Crypto Market

Stablecoins play a crucial role in the cryptocurrency ecosystem. They offer a way for traders to move in and out of different cryptocurrencies without converting to fiat currency, thus enabling liquidity. Additionally, they help reduce the volatility that is common in cryptocurrencies.

“Stablecoins enable investors to hold the value of their assets without needing to convert them back to fiat currencies, which can be cumbersome and costly.” – Authoritative Source

The Impact of Stablecoins on Market Stability

As the crypto market continues to grow, many believe that stablecoins could provide much-needed stability. They can serve as a safe haven during market downturns. For instance, traders can quickly convert their volatile assets to stablecoins, thereby protecting their investments.

Challenges Facing Stablecoins

Despite their benefits, stablecoins face numerous challenges:

- Regulatory Scrutiny: Governments worldwide are increasingly concerned about the lack of regulation surrounding stablecoins, which can lead to issues with fraud and instability.

- Liquidity Issues: Not all stablecoins maintain the same level of liquidity, which can create challenges when trying to convert them back into other cryptocurrencies or fiat.

- Market Trust: The success of a stablecoin largely depends on the trust it can maintain. If users lose faith in its backing, its value could plummet.

Understanding Stablecoins: The Key to Stability in Crypto

“The key to the future of stablecoins lies in transparency, regulation, and ensuring that there’s enough trust and backing in place.” – Authoritative Source

Future of Stablecoins

The future of stablecoins appears promising, with many experts predicting that they will continue to evolve. Innovations in this space may lead to enhancements in trust and stability. Possible developments may include:

- Improved regulation: As regulatory frameworks develop, they may enhance the security and trust in stablecoins.

- Interoperability: Future stablecoins might allow for seamless integration across various blockchain platforms.

- Increased adoption: More businesses may begin accepting stablecoins, further legitimizing them in the financial landscape.

Summary of Key Terms

| Stablecoin | A type of cryptocurrency whose value is pegged to a reserve asset to maintain price stability. |

| Fiat Currency | A government-issued currency that is not backed by a physical commodity but by the trust in the government. |

| Collateralization | The process of securing a loan or stablecoin issuance with an asset that can be seized if the loan is not repaid. |

| Volatility | A measure of how much the price of an asset fluctuates over time. |